The Nordic brands and operations of an international insurance company was concerned about sales leakage in their customer interaction processes and about commercial optimization of their end-to-end customer journeys across channels, distribution, and products. To address this, they needed to map all customer journeys, identify leakage points, and benchmark their commercial performance against best practice from within and outside the industry.

They called on CYBAEA and its partners to deliver this project as the recognized experts in delivering and exploiting commercial customer insights across industries, giving them the ability to benchmark current practice and build robust business case for change, and for their profound marketing expertise and deep insurance knowledge, combined with Nordic resources possessing local language skills and market understanding.

This review, benchmark, and business analysis identified new revenues worth over £33 million annually that could be delivered within 12 months, corresponding to over 5.5% additional gross written premium (GWP) with normal or below-normal risk that could be acquired at low cost.

Project approach

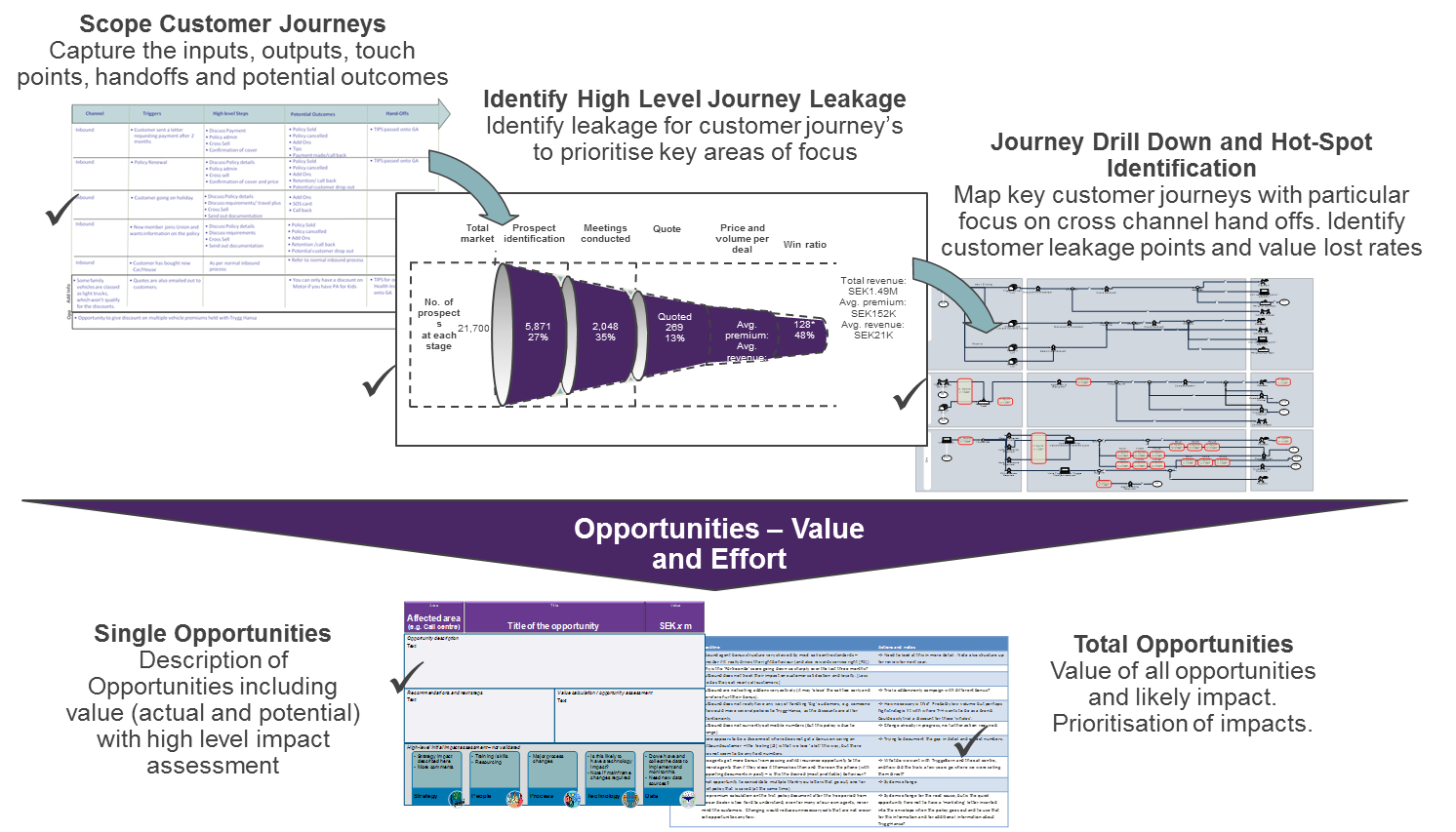

The entire customer journey was mapped across brands, geographies, carriers, channels, and all customer trigger points.

First, all the channel processes were documented with every customer interaction and a specific focus on leakage points in the process such as lack of follow-up.

Second, every customer journey was mapped with emphasis on cross-channel hand-overs to identify customer leakage points and value lost.

Third, all the opportunities for closing these leakage points were documented and sized for value lost and complexity to change.

Fourth, all customer journeys were benchmarked against within and outside the industry to identify substandard commercial performance and associated opportunities.

From this, a high-level opportunity map was created for the executive teams identifying 12 opportunity areas, ten of which could be quantified with available data as new revenues totalling over GBP 33 million (USD 52m, SEK 350m) gross written premium in a single country from opportunities already in the organization’s systems and processes with existing customers and leads.

The executive team had full confidence in the results and all bought into and committed to delivering the opportunities identified. There was a clear recognition of the need for organizational change to include a Customer Value Management function, which at the time was a new concept for the Insurance industry (though well-established in Telecommunications).

“The organization structure needs to have a ‘senior seat’ individual who sits over the channels and owns the end-to-end customer value optimisation. This function must incorporate channel management, customer strategy, customer planning, and customer contact management.”